How do you compute your minimum hourly rate so that you are not running your business at a deficit?

Notice how this article is entitled “Getting to your minimum hourly rate”. You can charge what ever you’d like as an upper bound and depending on the client you should! Working for non-profits or for large corporations, your rates should and will change. The most important thing to know is that every hour you are billing you are not setting yourself back!

(In this post I am always talking about to get an hourly rate, some people are billing in half-day or full-day increments. Everything below applies the same for you, just tweak the equations as needed)

Calculating your hourly rate

So how do you calculate your hourly rate? That’s easy, it’s the salary you want to make, divided by 52 weeks a year, divided by 40 hours a week. Simple!

For instance, if you want to make $50,000 a year, divided by 52 weeks that’s about ~$962 a week. Divided by 40 hours $24.05 an hour. That was easy.

That is an incredibly naïve and incorrect equation. It is a starting point, but it isn’t sustainable as a business. There are plenty of additional costs that this equation won’t cover. You’ve forgotten about your phone and internet bill, what about rent or a new computer? What about a lawyer, paper work fees or taxes?

Let’s look at a slightly more complex equation, but one that is still easy enough for you to plug-in your own numbers to get a minimum hourly rate that you should never go below.

We need to determine how many hours of your time you plan on working are billable. This is important because you are at work for ~40h a week, but you are not 100% productive, no one is and we should accept that. A portion of your week will be spent doing non-billable things, such as making coffee, sitting in meetings, doing administrative work or watching YouTube. So if we revisit the total number of hours in a week, we can get a new equation.

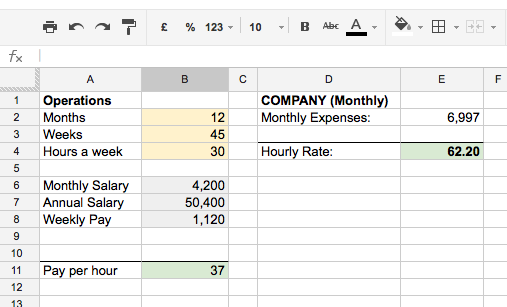

There are 12 months a year, 52 weeks a year, 40 hours per week. Now, lets be honest with ourselves, everyone deserves some vacation time – it might even be mandated in your country how many days a year. Then there will be sick days, plus public holidays. For a nice round number lets say you are only planning on working 45 weeks a year.

45 weeks * 40 hours = 1,800 possible billable hours a year.

Again, 40 hours is certainly optimistic, give yourself atleast an hour a day for lunch, maybe more.

45 weeks * 30 hours a week = 1,350 possible billable hours a year.

Over the course of a year, you have 1,350 hours to bill out to pay your salary.

Salary isn’t your only expense. Those 1,350h need to cover your salary, rent and plenty of other expenses.

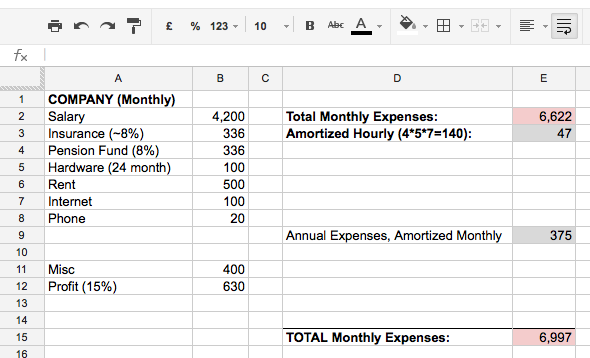

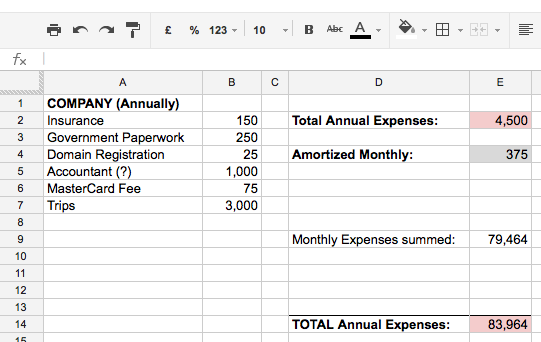

To get an overview, we created spreadsheet with a few tabs for data entry. One tab is for monthly expenses, these are things like phone, internet, rent, salary, salary tax, retirement fund, etc. These all get summed-up and multiplied by 12 so we know our annual total for these monthly expenses.

Then I have another tab with annual expenses. These are things like insurance, banking fees (yes, I have to pay for the privilege of having a company credit card), domain renewals, accountant fees, government paperwork, hardware refreshing, etc. I can then divide these by 12 to get the monthly cost for these fees.

I recommend that you do the something similar. List out all the items you pay for on a monthly bases and items you pay for on an annual basis. (You decide if things you pay semi-annually or quarterly go into which tab) After you do some multiplying and dividing, you can get to a much better estimate of your monthly burn. This is an important number to know, if you are not atleast bringing in this much each month, you won’t be able to keep the lights on for very long!

With all these totals, you are getting closer to calculating your hourly rate. You know the total hours you want to work per year, 1,350h and you know your total annual expenses (monthly x 12 + annual). You can simply divide total costs by the total hours to work out your hourly rate. This gets you the minimum you need to charge each hour to keep the company on par for the year.

See, it wasn’t so hard, but there is a catch. At this hourly rate, it means you aren’t earning any profit, you are running the company at cost. That doesn’t allow for ANY wiggle room for new projects, bring on more staff or unforeseen problems/costs. If you wanted to branch out an buy some ads or print new business cards, these weren’t in your expected annual budget and therefore are putting you in the red financially. The easiest way around this is to budget in a 10% (or more) profit each month as another line-item. Sum your monthly expenses and add 10%. This will trickle through the equations and recalculate your hourly rate.

Obviously, the more days, weeks, months and years you run your business the more accurate your expenses will become. Over time you’ll learn how productive you are each week and how many days/hours it takes you to land your next project. All the downtime in between projects where you aren’t billing needs to be covered by the hours you do bill.

Using this equation, you can now estimate a more accurate minimum hourly rate:

((12 * monthly expenses) + (annual expenses))/(weeks worked * hours worked per week) = minimum hourly rate

If you go below this number, even for a friend or charity, you are hurting yourself and your business. There is no shame in passing on work, if you are putting yourself in financial trouble.

The sigma of your rates

It always feels uncomfortable when someone asks what your hourly rate is. If you are having this problem, then maybe freelancing isn’t right for you. It seems that no one wants to be honest about their hourly rate probably because of two reasons:

- They really want or need this project and saying an hourly rate which is too high could immediately invalidate them from a chance of getting the project.

- They are worried that what ever comes out of their mouth will be so low that in the future they can’t go back on it and increase their rates.

If you are worried about losing a job because you are too expensive then you have two more problems. If you go below your hourly rate, then you are losing money. If you are too expensive even with your minimum hourly rate, then so be it and walk away. If you are worried about being too expensive and all the customer is worried about is cost, then they aren’t the best customer to have anyway. People are happy to pay a premium if they feel they are getting premium work. Sure, your rates might be higher than the competitors, but you are willing to answer the phone at strange hours or go out of your way to help or suggest new projects. You are worth your price. You can never and should never compete on price, that is just a race to the bottom. If you properly sell yourself to your customer, they might balk at your rates, but go out of their way to find the money to still work with you.

Never worry about being too high if you know your rates are reasonable.

What if your minimum hourly rate is too high?

This is certainly a possibility. You might have unreasonable expectations for yourself and therefore an unreasonable price. Someone new to the field can’t charge an expert’s fee. Maybe you are assuming you are worth more that the market thinks? We’d all love a million dollar a year income, but that’s not feasible. If you reduce your salary, then your hourly rate will also be affected. You might also look to cut some of your other costs, such as rent or wait longer to refresh your hardware. Do you really need to be paying so much or pay at all? Cutting your overheads reduces your rate, which gives you the ability to increase your rates slowly upwards at a later date after you’ve established your company.

Worrying about being too low

Worrying about being too low is also a non-issue. From a psychological point of view we are very loss averse, if we knew we could have made more money we kick ourselves for not. This is partly why you figure out your hourly rate in the first place. Much like going to an auction, you have a price in your head you are happy to be paid or to pay for something. At an auction, if it becomes too expensive you don’t chase it until you can’t afford it. You stop. With your hourly rate, you should be happy if they accept. Maybe you could have gotten more, but you should be entering into a relationship and for the next project you can potentially increase your rates or as we’ll see later, there are other options. Settle on an hourly rate which you would be happy receiving and don’t lament over what you could have milked out of a client, you’re in this together.

Things to watch out for:

- Multiple currencies: If you accept different currencies be sure not to lose when there is a converse charge and if/when the exchange rate fluctuates.

- Inflation: Keeping your rate the same year and year, and you are losing money when you consider buying power and cost of living. $5 today is not worth the same as $5 was 50 years ago.

- Administrative work, non-billable time: There are plenty of hours in the day that can not be directly attributed to a client and therefore are ‘lost’. Knowing roughly how many of these hours you have each week/month will help you in your equations.

- Famine and feast: there will be downtime between clients. It has happened to us. We’ve had great clients who loved us, then they get a new boss in their division and all projects stopped. It wasn’t anyone’s fault, but income we expected suddenly dried-up. Having a cushion so you can afford payroll is important.

- VAT/Tax: These are constants, but people tend to forget about these fees when estimating their rates.

- Legal Fees: You should ALWAYS have a lawyer, it will save you. Knowing how many hours and what their rates are can be difficult. Just like you are building a relationship with your customers, you should build one with your vendors.

- Products and deferred income: When you aren’t billing directly to a customer, but some of your income is coming from other sources, such as income from selling something en masse, it muddies-up your hourly rate estimates.

Some of these issues can be rectified in charging a higher amount to some clients than others. For every dollar you charge over your minimum to one client, don’t assume you can go below for another. Keeping you absolute base-line minimum across all clients means more profit into the company, which means you can bring on more staff to take on more work, try new projects, take some time off and still support yourself or save some for a rainy day.

Cost+

Everything we’ve been describing here is sometimes called ‘cost plus’. The idea behind cost+ is that you find out how much it costs to make a widget, and you add the profit you want to earn onto that price. For example if your widget cost $10 to manufacture, and want to make a profit of $1 on every sale, you sell it for $11. That is the basics of cost+. For a freelancer or small company, your costs are mostly salary. This directly equates to your minimum hourly rate. That is the cost of running the business. Now you just need to figure out the plus portion and add that to your hourly rate.

This is how most people have worked, you give a quote for the estimated hours and cost of the overall project. I have done this and probably will do this in the future, it is the safest way to make sure you survive another day. But it isn’t the best way to run a business.

Now that you’ve learnt how to estimate your minimum hourly rate, forget all about it. Keep that number handy, you can’t go below that, but it isn’t the way you should price yourself in the future.

Value-based Pricing

The preferred and more difficult way of pricing is something called ‘value-based pricing’. Some professions have been really good at variable pricing on their work. The rest of us need to learn from them.

Photographers have managed to get this right. For instance, they have one fee if an image used in an article, but a different fee if that same image is used on the cover. They are acutely aware that there is more value to the photo if it is a full-page spread or whether the circulation of the magazine is 1,000 or 1,000,000. Why should your work be any different?

Back in 1971, Carolyn Davidson created the iconic Nike Swoosh logo. She charged her hourly rate fee and was properly paid $35 for her time. That image went on to be one of the most recognized logos worldwide! She has since been paid an undisclosed amount of money, which is good for her. It goes to show that there can be a huge different between cost+ and value-based pricing.

There was a story about the great artist Piccaso at a cocktail party. A woman recognises him and goes over to make small talk. She finally asks the artist to draw her a sketch. So Picasso doodles out a sketch in 5 minutes and says, “That will be $10,000”. She looks at him and says, “But that only took you 5 minutes” and he replies “No miss, that took a lifetime”.

If you look at your skill set, we are all very talented individuals who are specialised in something, yet we are selling short a lifetime of hard work based on a few minutes or hours of work. Isn’t it better to work with a customer and succeed when they succeed? Doing so is more risky, but much more fair in the long run. You have a vested interest in doing great work and actually solving the problem rather than looking at the project brief and simply making the logo bigger like they asked.

Value-based pricing is much harder to sell than cost+, which is why so many people are still using cost+. Trying something different does give you the excuse to raise your rates or risk a chance at a better pay if you feel the project is truly something great. Just keep in mind your minimum hourly rate so that you are never losing on your hard work. I’m sure they will be times that you work closely with customers on a value-based pricing model, do the work and then the project is a flop for some reason beyond anyone’s control. You want to avoid dragging your financial problems into the mix if your rates were below your minimums.

Overall, value-based pricing is something to consider for your next project. Setting-up a new website for the local bakery shouldn’t be priced in the same way rolling out a website for a large company would – even if it is the same number of hours.

Now you’re ready

Go collect a list of all your monthly and annual expenses and put then into a spreadsheet to calculate your minimum hourly rate. You might be surprised at what you see! Take some time to do this because you’ll tend to forget expenses, like a new computer every 24-36 months or the annual company christmas dinner or maternity/paternity leave. Once you have that magic number, work to avoid having to use it. Experiment with figuring out what the customer’s real problems are and how you will work together to solve them and work for a percentage or the reach and audience. That’s the fair way to start a relationship.